Werner International Report Highlights Benefits of U.S.-CAFTA-DR Agreement and Devastating Impact of Weakening Agreement’s Rules

The National Council of Textile Organizations (NCTO) commissioned a critical report by Werner International examining the valuable economic and societal impact of the U.S.-Dominican Republic-Central America Free Trade Agreement (CAFTA-DR, which has spawned an integrated co-production chain in the apparel, textile and cotton industries supporting more than 1 million jobs and facilitating $12.5 billion in two-way trade.

The report was released as part of a public relations and Hill and administration advocacy campaign on January 26, supported by the co-chairs of the House Textile Caucus—Congressmen Patrick McHenry (R-NC) and Bill Pascrell (D-NJ).

In addition to the Werner report’s highlights of the resilient supply chain between the U.S. and CAFTA-DR region, the study also provides data-driven evidence of the adverse impact of proposals aimed at weakening the agreement’s carefully negotiated and longstanding textile rules of origin. Proposals by certain retailers and apparel brands to dismantle CAFTA-DR’s rules would have a devastating effect on the collective industries in the region and U.S. and result in massive job, investment and export losses, the report finds.

The Werner report comes at a pivotal time, as Xinjiang’s illegal use of forced labor is tainting imported consumer products and the global shipping crisis is diverting supply chains away from China.

NCTO will continue to do substantial outreach to ensure key stakeholders understand the severe impacts this would have across the whole industry. Staff will also engage with efforts on the Hill to create incentives to help onshore and nearshore more textile and apparel production.

Lastly, the study provides recommendations to the Biden administration, which is currently conducting a comprehensive review of root causes of migration issues associated with three Northern Triangle countries within the CAFTA-DR region.

Key Findings from Werner report:

Adverse consequences to adding flexibilities to/weakening the yarn forward rule:

- Destroys U.S. and Western Hemisphere textile employment, with a total projected loss of more than 307,000 U.S. textile and cotton farming jobs and a loss of 250,000 jobs in Central America’s primary textile industry.

- Devastates U.S. cotton farmers, currently employing 115,000 people in 18 states. Projected sales drop of 30% for U.S. and Western Hemisphere cotton growers.

- Provides direct and indirect backdoor access to Chinese textile inputs, further perpetuating Xinjiang forced labor.

- Chills future investment and destabilizes current investment in region. Over $1 billion in capital investments have been made in CAFTA-DR countries since 2005, which have helped create a vertical regional production chain. Weakened rules place major future and long-term U.S. investments at risk.

- Severely undermines defense procurement under the Berry Amendment and the domestic warm industrial base supplying mission critical items to U.S. armed forces. More than two-thirds of the U.S. textile and apparel industry would be wiped out, destabilizing the domestic textile military industrial base and its ability to meet surge production in times of military mobilization.

- Cripples efforts to construct a viable domestic/nearshoring supply chain for personal protective equipment (PPE).

- Exacerbates the flow of immigration, undermining the administration’s intended goal of spurring economic development in the region to address the root causes of outward migration.

- Exponentially increases greenhouse carbon emissions through transpacific shipping and Asian coal-fired energy.

Proactive steps to help improve the competitive position of CAFTA-DR region:

- Better coordination among lending agencies of the federal government, such as the U.S. Agency for International Development, Inter-American Development Bank, and Export-Import Bank, to ensure targeted, strategic investment in this sector and competitive low or zero interest financing and loan guarantees.

- Support for a comprehensive infrastructure plan with targeted, high-impact investments and competitive loans to upgrade regional power grids, roads, and local ports would pay immediate dividends.

- Provide incentives to the Western Hemisphere co-production chain for carbon emission reductions and sustainable products.

- Ensure trade stability in the region by maintaining maximum pressure on China, including enforcing the U.S. ban on cotton and cotton products made with forced labor in Xinjiang.

- Refrain from changing cumulation and short supply process, which would lead to a surge of third-country yarns and fabrics and displace hundreds of thousands of jobs in the region and U.S.

- Oppose granting duty-free access and other benefits through an expansion of the Generalized System of Preferences (GSP) program to apparel and textiles and negotiating free trade agreements with major Asian suppliers.

- Close the de minimis loophole for imports from China that allow goods valued at $800 or less to enter duty free if imported by one person on one day.

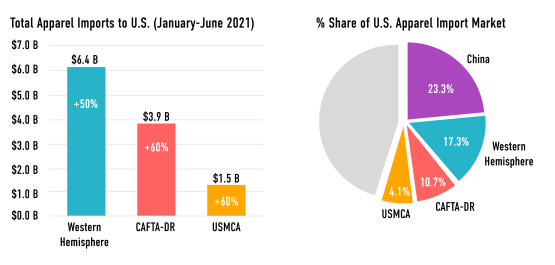

On a year-ending basis through June, the Western Hemisphere controlled a 17.4 percent share of the U.S. apparel import market, an increase of 7.4 percent.

On a year-ending basis through June, the Western Hemisphere controlled a 17.4 percent share of the U.S. apparel import market, an increase of 7.4 percent.

As part of a multi-phase $250 million capacity expansion plan, Glen Raven, Inc., a leading provider of innovative performance textiles, which includes such well-known brands as Sunbrella® and Dickson® in its portfolio, will create 205 new jobs as it expands its Custom Fabrics operations in Norlina, North Carolina.

As part of a multi-phase $250 million capacity expansion plan, Glen Raven, Inc., a leading provider of innovative performance textiles, which includes such well-known brands as Sunbrella® and Dickson® in its portfolio, will create 205 new jobs as it expands its Custom Fabrics operations in Norlina, North Carolina.