Precision Fabrics Group is staying the course and registering positive growth in key business segments, as it navigates the myriad challenges in the industrial textiles sector, beset by domestic and global supply chain disruptions, rising commodity prices and labor shortages in today’s pandemic-impacted economy.

Headquartered in Greensboro, N.C., Precision Fabrics Group—a new NCTO member–is an engineered materials business focused on highly technical, high-quality woven and nonwoven materials.

The company’s diverse portfolio represents a prime example of the U.S. textile industry’s innovative contribution and importance to the economic backbone of the U.S. economy.

Its core business is in industrial fabrics, centered around sophisticated weaving technologies and finishing chemistries for performance fabrics aimed at high-tech markets. The company specializes in designing fabric constructions for coating and laminating substrates, process and cure liners and other industrial applications.

In a testament to the company’s innovative might, Precision’s fabrics are also used in protective apparel, surgical garments, therapeutic bedding and aerospace safety equipment.

It has produced thousands of yards of fabric used to filter contaminated water in Guinea to help eradicate worm disease and also provided the woven release fabric used in the construction of emergency escape chutes, which were used in the 2009 emergency landing on the Hudson River in New York City.

Precision Fabrics Group was created in 1988 in a leveraged buyout from Burlington Industries, and continues today as a privately held company, employing approximately 600 associates and operates plants in North Carolina, Virginia and Tennessee.

In an interview, Byron Bassett, corporate vice president of Precision Fabrics, outlined the impact of the pandemic, and the ongoing challenges the company is facing and overcoming in a turbulent economy that is on the rebound but is still uneven due to new rising coronavirus cases associated with the Delta variant.

“The last two years have been the most uncertain that I have experienced in my 34- year career. There have been other times where the economy took a little dive and short term dip, but this one seems to be so protracted and the recovery so uncertain,” Bassett said. “It seems as if the economy has had more elasticity in years past.”

“We’re involved in the industrial sector and there is large portion of that industrial sector that essentially became a fraction of what it was pre-Covid– almost overnight at the onset of the pandemic last year. The sector is coming back now but the process of recovery is going to be a slow one in some areas,” he added.

The industrial textile sector, like all other segments of the U.S. textile industry, was impacted by shutdowns and economic downturn during the COVID-19 pandemic last year, but according to research highlighted in this summary of IFAI’s 2021 State of the Industry report, the outlook for the industry is positive.

“Collectively, companies in the industry…have positive expectations for their future. Some 62% expect their revenues to increase while only 5% expect a decrease (one-third are not sure),” IFAI said. “Overall, respondents expect an average increase of 8.5% in annual revenues over the next two years. Organizations serving the hospitality markets anticipate the highest increase in revenues (10%). Those serving manufacturing and agriculture anticipate slightly lower-than-average revenues.”

The research is based on findings from more than 300 members of the industrial fabrics community, gathered through an online survey fielded January–March 2021 that asked organizations about their businesses pre-pandemic (2019) and during the pandemic (2020), as well as their outlook for the future, according to IFAI.

Bassett said Precision Fabrics shares that optimism, having registered growth in the first half of this year, but warned there are headwinds slowing down the recovery.

SUPPLY CHAIN ISSUES DOMESTICALLY AND GLOBALLY

“We’re still waiting for yarns to run our looms. We’ve got 10 percent or 15 percent of our production capacity that has been hampered by [shortages] of raw materials. So on top of all of the other things, we are struggling to meet delivery schedules, which is a pretty common thing—as a result of these supply chain issues,” Bassett said.

He noted that supply chain problems downstream and upstream are impacting business and said domestic yarn manufacturers, non-woven produces and chemical companies across the board are having difficulty procuring polymers, necessary to run supply raw materials, as well as shortages in manpower to run them.

“There is a myriad of reasons that are hard to put together. We had a terrible winter down in the Gulf, which impacted the petrochemical based stocks. We had plant shutdowns because of COVID that reduced production outputs. There has been a lot of competition for commodities,” Bassett said.

“As our order books have strengthened over the last 6 months, priming the pump has been difficult, as a result.”

Another challenge causing supply chain disruptions has to do with the sheer magnitude of the effort necessary to ramp back up industries, many of which were temporarily shuttered for several months, particularly in the U.S. petrochemical industry, which supplies the majority of polymers to the textile industry.

Upstream manufacturers are also facing severe supply chain delays and issues.

For example, the automotive industry is a strong business segment for Precision, which makes nonwoven acoustic fabrics for the interior of vehicles to address sound absorption.

While consumer demand is high for new cars, an ongoing computer chip shortage, has severely impacted the production of new automobiles.

“The automotive business is a really good example where secondary or tertiary level supply chains are impacting every other tier of suppliers,” Bassett said. “They are saying this chip shortage will last into next year. Then we expect a surge because of pent- up demand. This turbulence is going to continue. How do you take a manufacturing process and ramp up from 30 percent of historical production volume to 130 percent of historical production volume? How do you forecast that?”

Rising raw material prices and freight surcharges on imported inputs are also putting pressure on margins.

“Raw materials are increasing in price; the cost of freight particularly sea freight is at all-time highs and some suppliers are implementing surcharges on components made from feed stocks that are on allocation. The combination of these factors require PFG and other companies to rethink their strategies as the demand in the market improves, Bassett said.

WOKFORCE ISSUES—LABOR SHORTAGES

As business continues to come back online, NCTO member companies are facing one of the more dire labor shortage environments in history, in line with every other major industrial, retail and transportation sector across the country.

The textile industry was recently listed as one of seven industries “most desperate for workers,” by the Washington Post.

Shortages are so acute that manufacturers have had to turn down contracts from businesses, including those that want to make their goods here in America.

“From my perspective, there has been a change in our culture, a change in how people view themselves relative to companies themselves and what they see as their part in it,” Bassett said. “We are going to have to find some creative ways to keep people engaged, particularly in manufacturing. I don’t think young people graduating from college today are thinking: ‘If I could only get into manufacturing and work for 45 years, I’d have a great career.’”

Bassett said the labor shortages are also driven by a generational gap and retiring Baby Boomers.

“We’ve got Baby Boomers that have worked in manufacturing for 40 years and are looking forward to retirement. A lot of those folks have worked with us for a very long time and we’ve relied on them. Filling those jobs over the next 5-10 years is a key focus. That is the essence of where we are going as a manufacturing company—we are going to have to figure out how to replace that know-how.”

IMPORTS AND RESHORING

Bassett said there continues to be price pressure from imports, particularly on lower-cost fabrics.

“There are situations where import prices are below our material costs. Some countries see it as a huge opportunity to take a long-term approach and dominate our markets. They have easy access to our market and are willing to invest in the those markets in the short run at lower margins to try choke out the domestic supply base,” he said.

The domestic industry is fully aware of the cost of producing polymers and can easily identify when imported textile components are imported into the U.S. market at below-market prices.

“We’ve seen countries support their industries and I just think there are a lot of reasons for our federal government to make it a strategy to rebuild the U.S. textile industry,” he said. “I don’t think we will make T-shirts here but we need a thriving textile industry in this country as part of an overall, nationwide manufacturing strategy. We are part of what needs to be here for the long run.”

He added that he is seeing a willingness on the part of Precision Fabric’s customers to reshore.

But he cautioned that in some segments such as personal protective equipment (PPE), “memories are quite short and people have reverted back to imports.”

He said foreign suppliers often try to combat reshoring by offering even lower prices as an incentive lure companies back offshore.

OUTLOOK

Despite the challenges and other headwinds, Bassett said on balance Precision Fabrics is seeing an increase in orders and business is coming back.

“We’ve absorbed extra costs when things were leaner last year, and as we are digging out, we have tried to maintain as much continuity as we possibly can. We think that’s good for everybody in the long run,” he said. “It has been our philosophy to stay the course. We’ve got a lot of loyalty in our workforce and recognize that we’ve got skills in our manufacturing operations that would be difficult to replace once lost. It is important that we keep those associates working so that we are prepared to handle the volume when the market rebounds.”

The sectors related to “heavy industry” such as construction, aerospace and even automotive, despite ongoing supply chain issues, are areas where the business is coming back, he said.

Finally, Bassett said the industrial textile segment is “probably the one category in which we can survive as a domestic manufacturer.”

“Low-cost commodity fabrics or consumer items cannot be our focus. We have to continue innovating and take on the most technically challenging applications in our industry. Once something becomes commoditized, we need to replace that business with an innovative product, one that is more financially sustainable. It is that kind of strategy that will provide a real future for the American textile industry.”

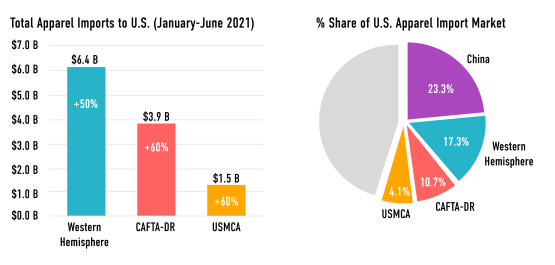

On a year-ending basis through June, the Western Hemisphere controlled a 17.4 percent share of the U.S. apparel import market, an increase of 7.4 percent.

On a year-ending basis through June, the Western Hemisphere controlled a 17.4 percent share of the U.S. apparel import market, an increase of 7.4 percent.

As part of a multi-phase $250 million capacity expansion plan, Glen Raven, Inc., a leading provider of innovative performance textiles, which includes such well-known brands as Sunbrella® and Dickson® in its portfolio, will create 205 new jobs as it expands its Custom Fabrics operations in Norlina, North Carolina.

As part of a multi-phase $250 million capacity expansion plan, Glen Raven, Inc., a leading provider of innovative performance textiles, which includes such well-known brands as Sunbrella® and Dickson® in its portfolio, will create 205 new jobs as it expands its Custom Fabrics operations in Norlina, North Carolina.